missouri gas tax rebate

By then the total gas tax including the hikes will be 295 cents per gallon. The first of five annual gas tax increases of 25 cents per gallon takes effect reaching a total increase of 125 cents by 2025.

Georgia Legislature Votes To Suspend Gas Tax Sends Bill To Governor

Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025.

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

. The refund is only for the increased portion of the tax. Taxpayers earning less than 100000 should be getting a check for 300 and 100 checks for anyone making above the threshold. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923.

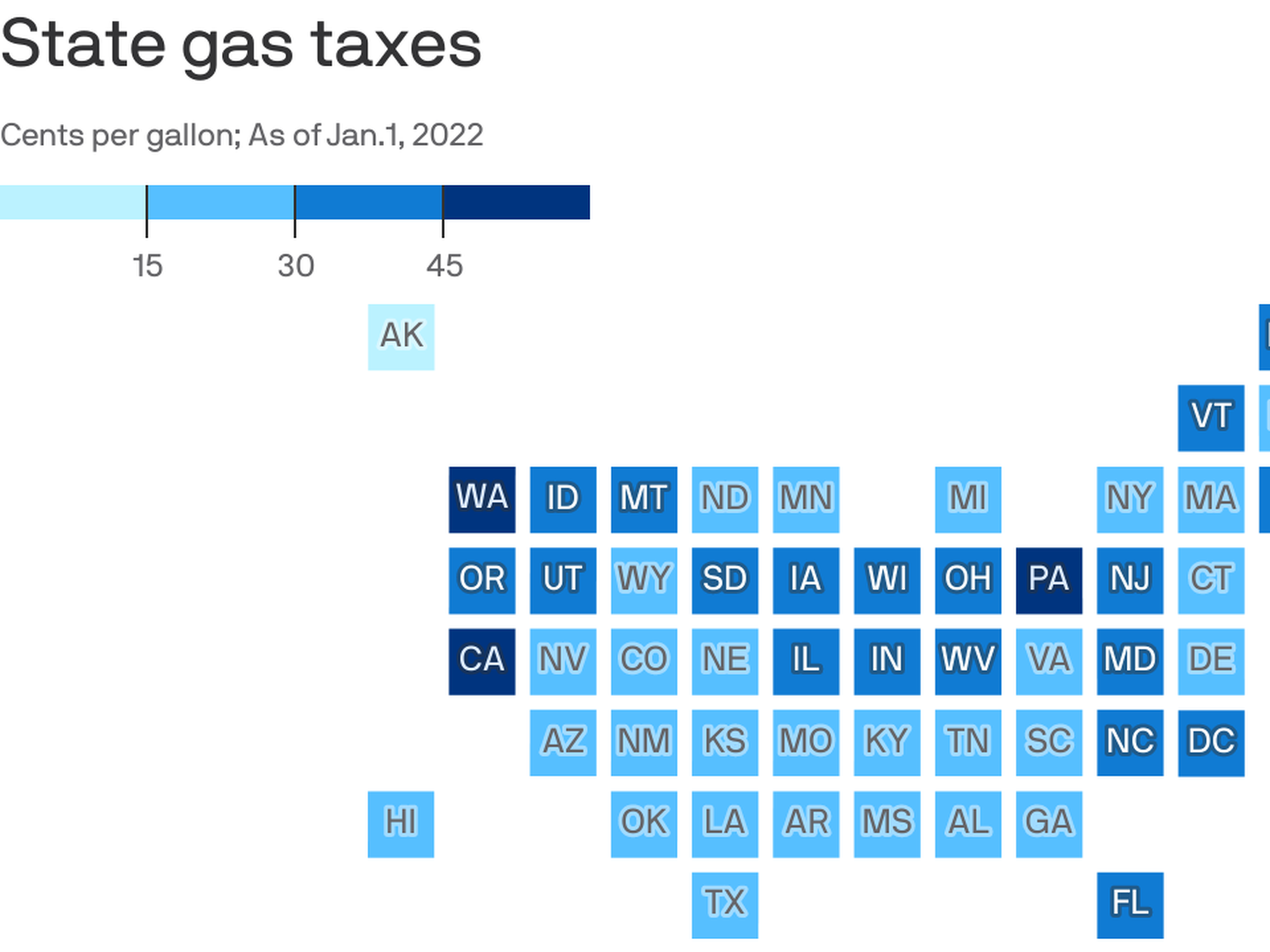

That might not seem like a lot but. At the moment Missouri has one of the lowest gas tax rates in the nation. Under Ruths plan the gas tax would rise by two cents per gallon on Jan.

1 2021 through June 30 2022. It was the first gas tax hike in 25 years but it will keep increasing by 25 cents per gallon every year until 2025 according to Missouri Department of Revenue. Missouris first motor fuel tax increase in more than 20 years takes effect on Oct.

The tax will continue to increase 25 cents a year until it hits 295 cents in 2025. There is a way for Missourians to get. What Does the Missouri Gas Tax Rebate Mean for You.

You must keep your receipts from every. The increase would go into effect in October of this year. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for.

Instructions for completing form. Form Print Form Missouri Department of Revenue Motor Fuel Refund Claim Form Office Use Only Keyed Date Document No r FEIN r Social Security Number r Driver License Number Name City Claimant Mailing Address Phone Number Alternate State ZIP Code Fax Number - E-mail Address Avg Price Per Gal Gasoline See instructions The refund claim must be filed within one year of. Fuel bought on or after Oct.

For someone who drove 15000 in a year in a vehicle averaging 30 miles per gallon the refund on the 25-cent tax would be 1250. 1 but Missourians seeking to keep that money in their pockets can apply for a rebate program. Since October 1 the states residents have been paying an additional 25 cents per gallon of gas.

The State of Missouri currently has one of the lowest gas tax rates in the country at 17 cents per gallon. Representatives Mike Thompson of California John Larson of Connecticut and Lauren Underwood of Illinois proposed the Gas Rebate Act of 2022. Americans are feeling the impact at the pump of Vladimir Putins illegal invasion of Ukraine and right now we must.

Becky Ruth chair of the House Transportation Committee. Fuel bought on or after Oct. LOUIS For the first time in a quarter-century Missouris gas tax has increased.

Refunds The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. Theres a way that money could end back up in your pocket. Vehicles under 26000 pounds and registered in the state of Missouri are eligible for.

By Cameron Gerber on September 30 2021. People looking to be reimbursed will. Americans are experiencing increased prices at the pump as oil prices hover around 100 per barrel.

Vehicle weighs less than 26000 pounds. Since last Friday the Missouri gasoline tax has gone up 25 cents a gallon. Pursuing the refund might not be worth it to some drivers.

Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. Cody Smith R-Carthage would be based on a tax filers total annual income tax bill for 2021. If someone owes the state 500 or more they would receive the full.

1 2022 and will then increase by an additional two. 1 2021 the date Missouri most recently increased its gas tax. Tax rebates are in order for Idaho residents.

The NoMOGasTax app is only available for Apple products and has a onetime fee of 499. In addition you may submit your own spreadsheet detailing the requested information on Form 4923S in lieu of Form 4923SIf you choose to submit Form 4923S or a spreadsheet you. The gas tax will increase every July until 2026 topping off at 295 cents per gallon.

Refund claims can be submitted from July 1 2022 to Sept. Once done the gas tax rate will sit at 295 cents per gallon. The Missouri gas tax will go up 25 cents every year until the gas tax reaches about 30 cents per gallon.

Missourians can request a. Form 4923 must be accompanied with the applicable Form 4923S Statement of Missouri Fuel Tax Paid for Non-Highway Use. Once fully implemented in 2025 the tax increase is expected to.

Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Missouris gas tax is 195 cents after the 25 cent increase in October 2021. Ige proposed 100 refund for all taxpayers an dependents.

KANSAS CITY Mo. Missouri holds one of the lowest gas tax rates in the country at just 17 cents per gallon. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon.

30 2022 on purchases made after Oct. In January 2022 Gov. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if.

The first of five annual gas tax increases of 25 cents per gallon takes effect. Either 75 or 12 of their 2020 tax return will be direct deposited. The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs.

The tax will increase yearly between now and 2025. Drivers must file the rebate between July 1 and September 30 of each year. 1 drivers filling up in Missouri will pay.

Vehicle for highway use. JEFFERSON CITY Mo. The increases were approved in Senate Bill 262.

The Department will accept either a completed Statement of Missouri Tax Paid for Non-Highway Use Form 4923S or the original invoices to accompany a Non-Highway Use Motor Fuel Refund Claim. State leaders said the average Missouri driver driving 15000 miles a year would get a rebate of about 12 after filling out the proper paperwork. The rebate sponsored by Rep.

Missouris new gas tax would add 25 cents per gallon until it hits 295 cents per gallon in 2025.

Missouri Fuel Tax Increase Goes Into Effect On October 1

Save Your Receipts Missourians Can Apply For Refund On State Gas Tax Increase Later This Year

Gas Tax Cut Again In Missouri Nextstl

Us May Suspend Federal Gas Tax Chinadaily Com Cn

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

These Two States Passed Gas Tax Suspensions More May Follow Abc17news

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Como Gastar 0 En Gasolina El Mes Que Viene Infografia Infographic Infografia Gasolina Medioambiente

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri S New Gas Tax Hassle Show Me Institute

Gas Tax Holiday These 17 States Are Working On Legislation To Ease Costs At The Pump Gobankingrates

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Pennsylvania Bill Would Lower State Gas Tax Axios Philadelphia